Free Advice For Deciding On Credit Card Apps

Wiki Article

What Is Deemed Suspicious Behaviour And Lead To The Blacklisting Of A Credit Card?

Many behaviors or actions could be suspect and result in the credit card to be blocked or flagged. A few examples are: unusual spending habits

A sudden increase in expenditure or large transactions in comparison to normal behaviour of a cardholder can raise suspicion.

Unrecognized transactions

Any transactions that are not authorized or unidentified on the card statement that the cardholder didn't create or approve of could be indicative of fraud.

Multiple declined transactions

If you have a history of transactions that are good, but the cardholder is experiencing a number of failed or declined transaction in a short amount of time, this could be an indication that something is wrong.

Geographic Anomalies

Transactions that are made in places far away from the typical locations of spending, or transactions made from multiple geographic locations over a short time frame can cause suspicion.

The types of purchases that are Abnormal

You should report as suspicious any purchases that aren't your usual, such as high-value goods that aren't in line with your spending routine.

Uncommon Online Behavior-

Unusual online behavior such as multiple failed logins, a change in the information on your account, or suspicious log-in attempts, may indicate an unauthorized intrusion.

Unusual Card Use

It could be suspicious if the card was used in a way that is not consistent with its usual use, for instance, in the event that it was utilized to make international purchases when the card has been mostly used locally.

Rapid Cash Advances and Transfers

Cardholders could receive alerts for advances or cash transfers that are outside of their typical spending practices.

Frequent Card Transactions that are Not Present

A rise in transactions by a credit card that isn't present (online or over the phone) without a previous history could be an indication of fraud.

Identity Verification Issues

If you're having difficulties checking the identity of the card holder when you make transactions, it could be a cause for suspicion, especially if further verification is required.

Card issuers can be affected by these and other behaviors to look out for fraud or identify it. They may look into the issue or stop the card until the legitimacy or identity of the transaction can be verified.

What Is The Meaning Of My Credit Cards Are Included On A List Of Blacklisted?

Being placed on a blacklist could limit the use of a card or transactions until the issue is resolved. There are a variety of reasons for why a credit card might be placed on blacklist.

Card blocked for security reasons If you suspect fraud, your credit card could be revoked if it is able to detect unusual or suspicious transactions.

Security Issues: If there are indications of a breach (unauthorized access or data breaches that involve cards, or unusual spending patterns), the card can be tagged for security reasons.

Issues with Identity Verification. If there is difficulty in verifying the ID of a cardholder when making transactions (especially when additional verifications are required), the card can be temporarily suspended.

Card Lost or Stolen - If you report the loss or theft of your credit card, an issuer will block access to the card until a replacement has been issued.

Suspicious Activity Indicators - Any act or occurrence which is linked to the card and could raise suspicion can trigger immediately a block. For example, multiple declined transactions, geographical anomalies, or irregular spending patterns.

A card that is listed on the blacklist may limit the cardholder's ability to obtain credit, or to make purchases with the card. This could be until the issuer has confirmed the authenticity of the account or resolves any concerns regarding security or fraud. Cardholders need to immediately contact their issuer to let them know about the problem and to verify the transactions and resolve any security issues.

Who Is Qualified To Examine Credit Card Numbers On An Blacklist?

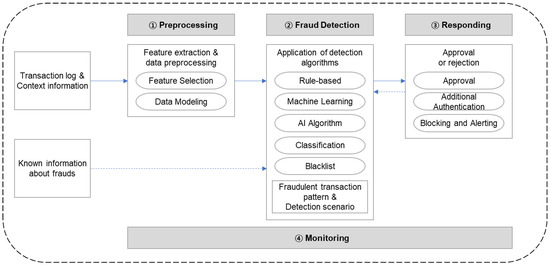

The authorized professionals of law enforcement agencies, financial institutions or cybersecurity companies verify a credit card numbers against a blacklist, or verify fraudulent activity that involves credit cards. They include Fraud Analysts- trained individuals within financial institutions who specialize in the detection and investigation of fraudulent activities associated with credit card transactions. They employ special software and tools that detect patterns, anomalies, and potentially compromised card details.

Cybersecurity Experts: Professionals that specialize in cybersecurity, focusing on analyzing and identifying cyber-related threats, including compromised credit card information. They focus on protecting against data breaches, analysing data for signs of compromise, and taking security measures.

Law Enforcement officers- Specialized units, or individuals, in law enforcement agencies that investigate frauds and financial crimes, including credit card fraud. They can access databases and other sources to identify and analyze frauds.

Compliance Officers- Professionals responsible for ensuring that banks comply with the laws and regulations related to financial transactions. They may oversee processes for identifying and reporting suspicious activities that involve credit cards.

Access to databases that have credit card blacklists is strictly controlled and requires legal authorization. For example, being a part of an official inquiry into financial crime or receiving specific authorizations from authorized entities are examples.

The teams and individuals who are certified use specific software, protocols, and legal processes to check information about credit card transactions against blacklists while adhering to strict privacy and security regulations. Only rely on an authorized professional or organization when you are concerned about your the security of your credit card data that could be compromised. Inappropriate attempts at accessing or utilizing blacklists for credit card information could result in legal consequences. Follow the top savastan0 cvv for website tips.